Download the full report above.

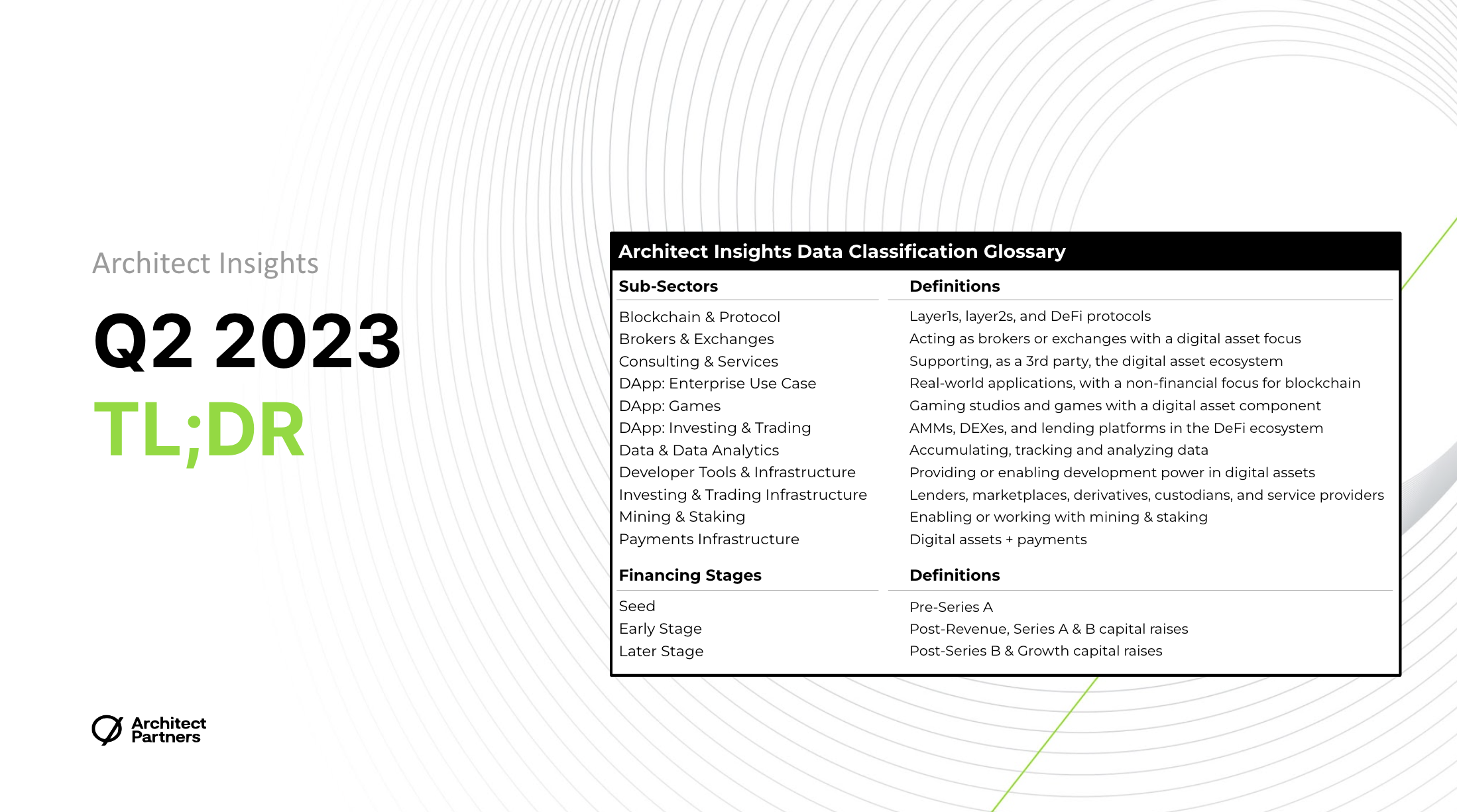

Crypto Mergers & Acquisitions

Q2 2023 Crypto M&A activity declined from the trend established over the past three years, dipping to Q1 2021 levels.

Comparable sectors such as technology and financial technology faced even sharper declines in volume.

BitGo’s proposed acquisition of Prime Trust (for 15 days before being abandoned) demonstrates that the lack of basic prudent management continues to plague our industry.

Regulatory uncertainty, particularly in the U.S., continues to adversely impact M&A with Coinbase and Binance now embroiled in a protracted regulatory action by the SEC.

Prospects for improvement? Pricing for Bitcoin, Ethereum and the public crypto equity markets suggest optimism. We’re leaning toward pragmatic optimism.

Crypto Private Financings

Crypto private financing declined 75% in the first half of 2023 versus first half 2022. The number of financings remained fairly flat the past three quarters, but the amount raised has declined, especially for later stage rounds, consistent with broader tech.

The most active lead investors in 1H 2023 were a16z, CoinFund, Blockchain Capital, Outlier Ventures, Shima Capital and Animoca. All were top prior year investors – but none invested at even half their 2022 pace.

The first half saw only six financing rounds over $100M. The largest was a $250M round for eToro after canceling their SPAC plans – note that this was negotiated in 2021. The second largest was a $125M Series B for Blockstream. The third largest was a $120M Series B for LayerZero. This transaction felt like a return to early 2022 – a real Series B round size, at a solid valuation uptick, with a roster of quality investors.

Crypto Public Companies

The public crypto markets offer a bright spot for the quarter. Stock prices across our index rose by an average of 35% in Q2 2023 and 191% for the full first half of the year. Network Operators (mining companies) gained the most, growing 54% in Q2 2023 and 277% for the year so far.

Investment platforms however were more muted, with with the sub-sector largely flat at 0.4% as Investors likely priced in the active scrutiny and high-profile enforcement actions into effected shares. Interestingly, Coinbase showed a modest gain of 6% for the quarter, after losing ground but then reclaiming 39% in the weeks following the SEC suit initiated June 6.

Also notable is the continued decoupling of the public crypto sector from the price of Bitcoin. BTC ended the quarter at $30,405, for a modest 6.51%, suggesting that public crypto sector is breaking from historical correlation with the coin that started it all.