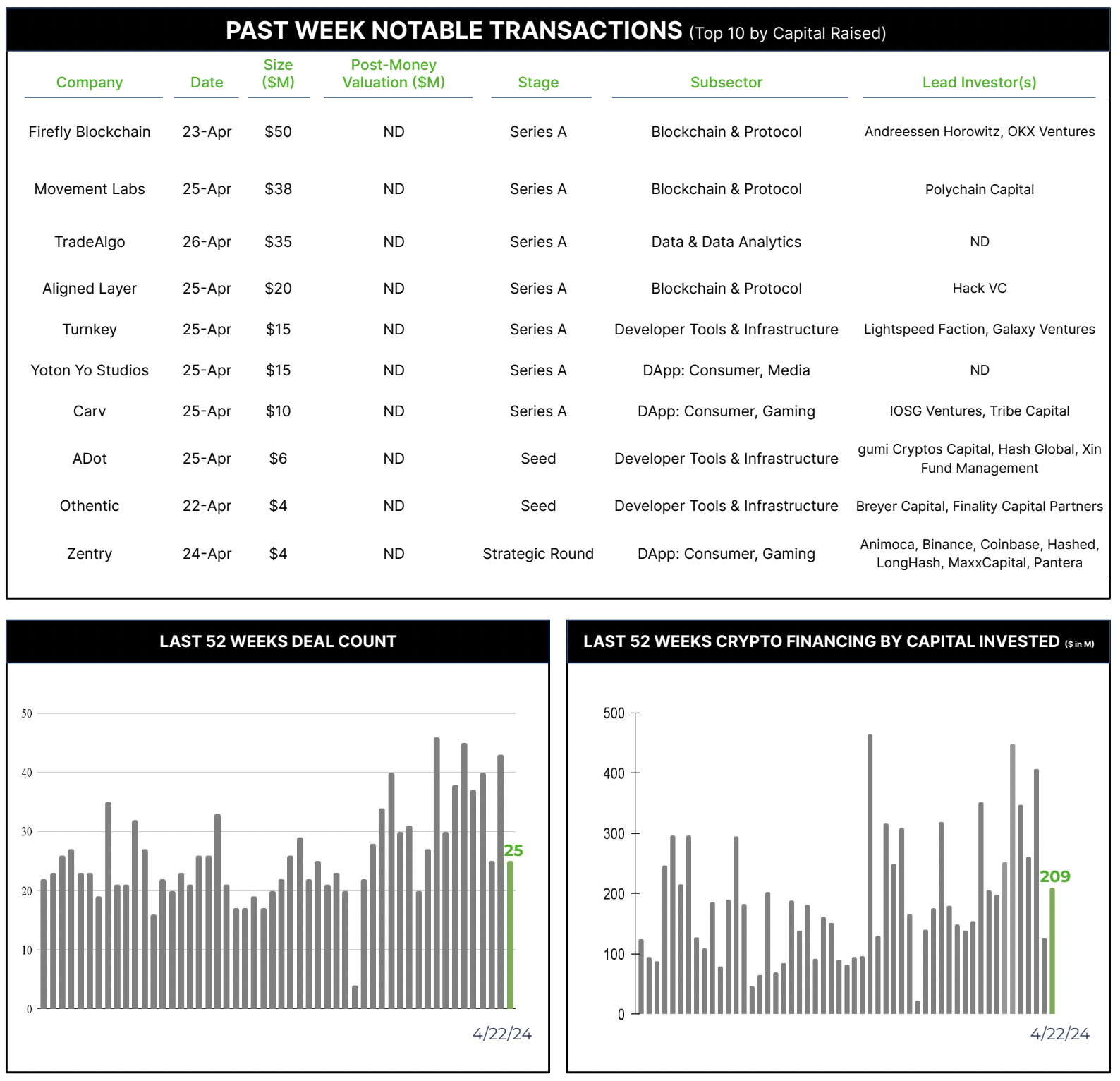

25 Crypto Private Financings Raised ~$209M

Rolling 3-Month-Average: $260M

Rolling 52-Week Average: $193M

Facebook envisioned Diem, its stablecoin, as part of a larger project involving Move, a programming language for creating secure financial applications. Diem aimed to be a stable, reliable cryptocurrency for global transactions. Facebook hoped users could send and receive Diem across its platforms (WhatsApp, Facebook Messenger, etc.) for things like paying friends or online purchases. Move would act as the secure foundation for building applications on the Diem blockchain. Move’s focus on safety aimed to ensure the smooth operation of Diem transactions and prevent errors or hacks. Diem ran into regulatory hurdles and Architect Partners managed the sale of Diem to Silvergate Bank.

What has happened to Move since Diem’s end?

Move’s focus on security was the basis for the creation of the Sui and Aptos blockchains, both developed by ex-Facebook employees who were aware of Move’s benefits. However, many thought the security benefits of Move would be valuable to a much broader audience.

Movement Labs is creating Move-based platforms for broader utilization by delivering modular move-based blockchains starting with M2, a Move Virtual Machine L2 for Ethereum. The focus of these Move Virtual Machines is solving security concerns surrounding smart contract vulnerabilities, improving the developer experience, as well as enabling additional advancements. Movement Labs will also be offering Move Stack, which will allow the Move Virtual Machines to be available on multiple blockchains.

The potential of Move, along with Movement Labs’ proven advancements, was the investment thesis behind a $38M Series A in Movement Labs led by Polychain Capital with participation from Hack VC, Placeholder, Archetype, Maven 11, Robot Ventures, Figment Capital, Nomad Capital, Bankless Ventures, OKX Ventures, dao5, and Aptos Labs.

Movement Labs’ solutions are still under development, and its long-term performance remains to be seen. However, its design holds promise for achieving scalability and security in blockchain applications.