Gaming is approaching a $200B annual revenue business today, perhaps surprisingly, 3x larger than the traditional film and television market. The magnitude of value created is staggering; multiple trillions of dollars of equity value have been created by companies engaged in building and supporting games.

Every decade or so, the gaming industry embraces new platforms and associated revenue and business models – not to replace but to extend their business. Examples include game consoles, handhelds, PC, mobile, cloud, free-to-play and play-to-earn games, VR headsets, etc. The most recent and perhaps most impactful innovation to date is blockchain-based games. Why is this so impactful?

Blockchain and crypto assets open the doors to the creation and preservation of realizable value to players (and developers) in ways that were previously either discouraged or impossible. Games often have exceptionally complex “walled economies” with in-game currencies, earning mechanisms and a myriad of ways to spend and invest. Typically, fiat value plus player time is invested for the right to play and create in-game assets. With the advent of in-app purchases, the WSJ reported a staggering 75% of gaming revenue was attributable to in-game purchases of virtual goods. For the most part, all this value is stuck and never realized by transferring to other games or converting back into fiat. A player’s investment of money and time is never paid off. Blockchain and crypto enable the payoff, with profound implications: players get to own their earned or purchased game assets and developers get new downstream residual revenues when those assets are created or sold.

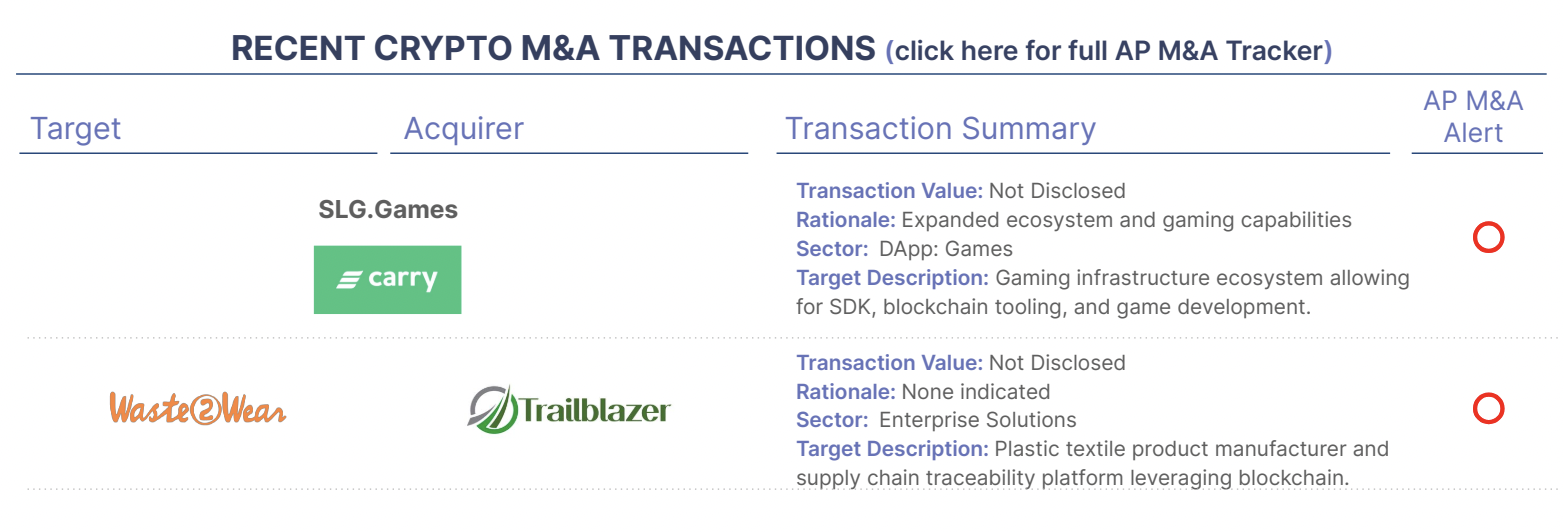

This is why blockchain gaming has attracted $15B in investment capital to date. We count hundreds of active blockchain-based games today, with over 500 new games in development (Source: DAppRadar, Big Blockchain). This topic is beginning to show itself in M&A as well, as demonstrated by the proposed merger of Carry and SLG.Games announced on Friday. Carry helps blockchain game developers monetize via advertising. SLG.Games simplifies game development by offering blockchain-based capabilities (often referred to as Web3) like token minting, management, trading, governance and game data analytics, all via a SDK. Carry is offering a token exchange, functionally similar to a stock swap, to SLG.Games token holders. The transaction has a nominal value of approximately $165M. As we highlighted two weeks ago, yes, decentralized M&A is a thing!