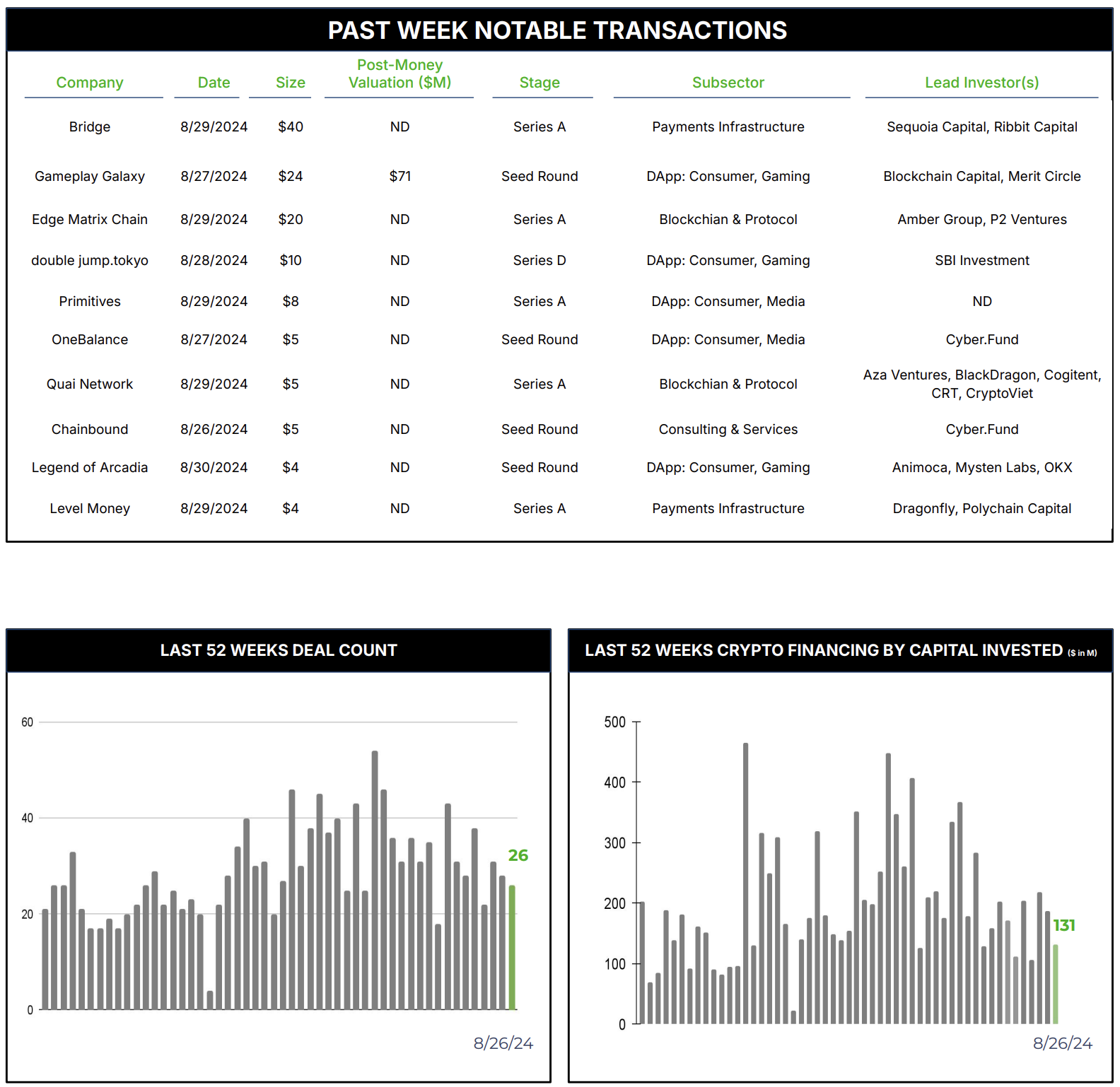

26 Crypto Private Financings Raised ~$131M

Rolling 3-Month-Average: $174M

Rolling 52-Week Average: $198M

The online gaming industry is a colossal force in the global entertainment landscape, with staggering growth and economic impact. In 2023, the global online gaming market was valued at $87.22 billion and is projected to reach $229 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.7%. With 2.82 billion online gamers worldwide, the industry’s reach is unprecedented, spanning diverse demographics and geographies.

With this as a background, the race to dominate Web3 gaming is on. Gameplay Galaxy, a game development company, recently raised $24 million in a seed funding round led by Blockchain Capital and Merit Circle. This significant investment can be attributed to several key factors that have positioned the company as a promising player in the evolving gaming industry.

Gameplay Galaxy has a proven track record of success in the mobile gaming market. The company is behind the popular “Trial Xtreme” series, which has amassed over 250 million downloads. This demonstrates their ability to create engaging and widely appealing games, giving investors confidence in their capacity to deliver successful products.

Gameplay Galaxy is also at the forefront of the Web3 gaming revolution. They are developing “Trial Xtreme Freedom,” a Web3-based extreme sports game that incorporates innovative features such as player-owned tracks, in-game asset ownership, and token earning mechanisms. This aligns with the growing interest in blockchain-based gaming and the potential for new economic models within the gaming ecosystem.

The company’s vision and approach to Web3 gaming have resonated with investors. Gameplay Galaxy sees Web3 as a natural evolution of the Free-to-Play model, focusing on integrating digital ownership and decentralized economies into familiar gaming settings. Their emphasis on creating a seamless transition for users from traditional games to Web3 experiences, while potentially driving superior key performance indicators, has contributed to investor confidence in their ability to achieve widespread mainstream success in the Web3 gaming space.