December 16th – December 22nd

PERSPECTIVES by Eric F. Risley

Loss of funds due to fraud is unacceptable under any circumstance.

Of course, this is a reality in our industry and within the financial services industry in general. However, normalizing the notion that it is part of the “experiment of crypto” is unacceptable.

This strong statement is a long-overdue response to a Twitter post by a prominent member of the crypto industry several years ago who suggested otherwise. This still bothers me today. Security is the absolute number one principle of crypto, and we cannot compromise.

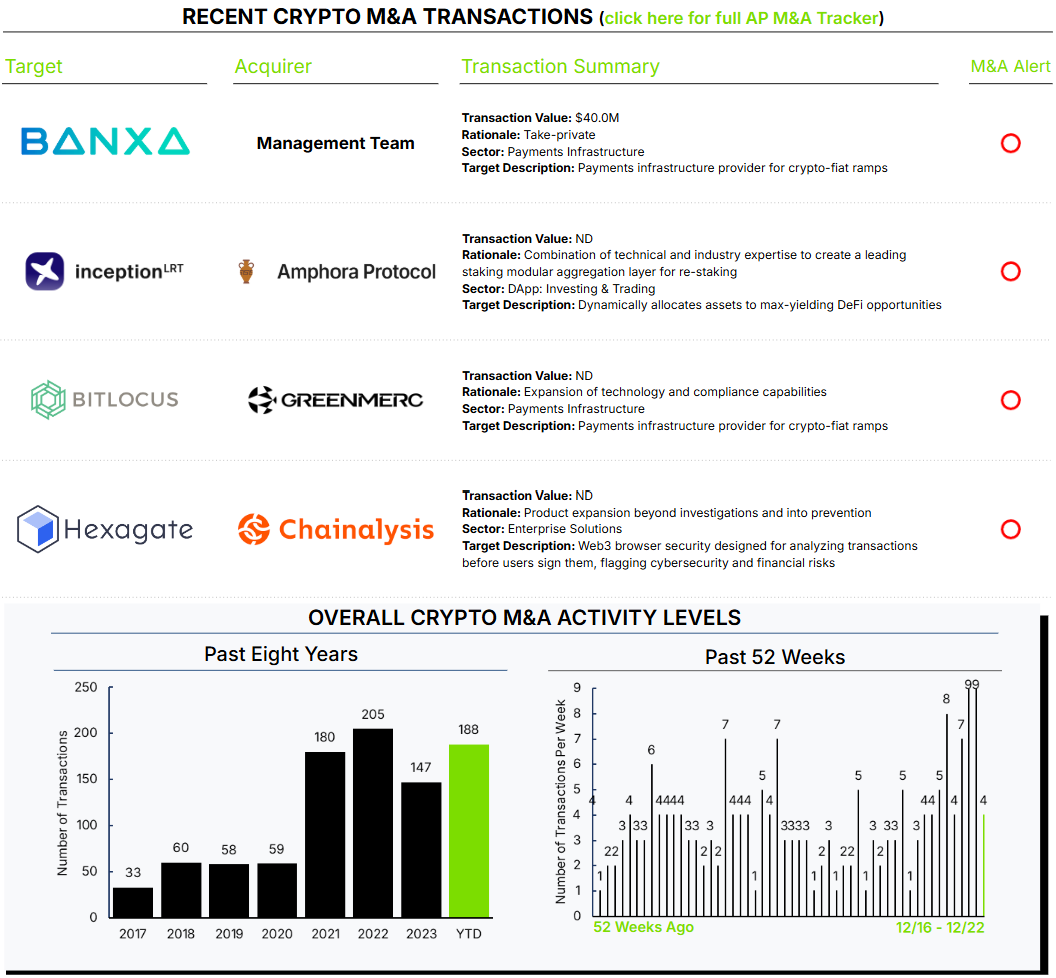

On that theme, we were pleased to see Chainalysis announce the acquisition of Hexagate as a strategic step beyond post-facto investigations toward the prevention of security breaches and nefarious behavior. Hexagate focuses on “detecting and mitigating real-time threats, including cyber exploits, hacks, and governance and financial risks.” This move echoes the evolution of internet security, shifting from reacting to security breaches and attacks to preventing them with real-time analysis and immediate countermeasures when attacks are identified. Of course, this is easier said than done, but the evolution of internet security demonstrates that significant improvements in crypto security are likely. Chainalysis also demonstrates that mergers and acquisitions are a time-proven tool to execute strategy, particularly when entering new or adjacent markets and products.

Lastly, in what may be a first, a public crypto company is going private. This week, the Banxa management team announced a proposal to acquire all the issued and outstanding common shares of the company, excluding shares held by certain directors, executive officers, and other individuals who have agreed to retain their holdings.