December 2 – December 8 (Published Dec 11th)

PERSPECTIVES by Todd White

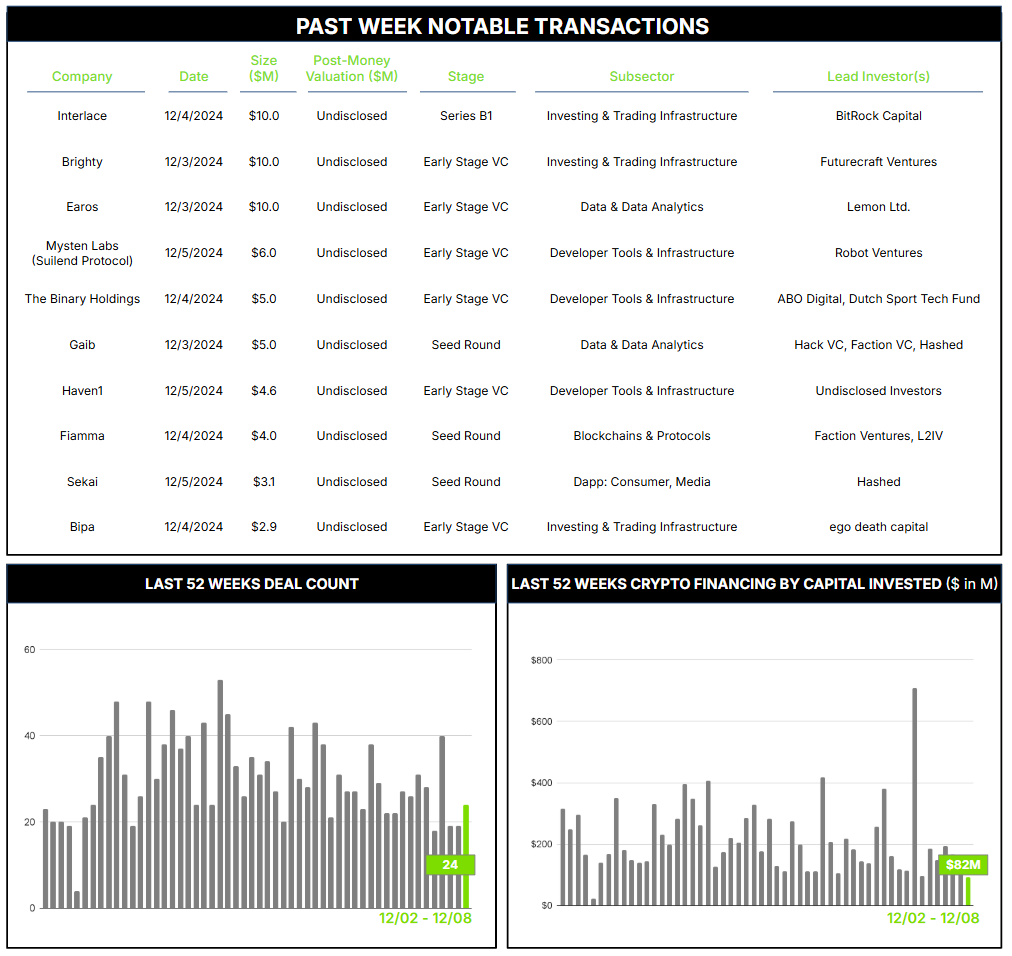

24 Crypto Private Financings Raised: $82M

Rolling 3-Month-Average: $206M

Rolling 52-Week Average: $213M

Crypto-focused credit cards have been around for some time, providing a familiar and convenient tool to earn crypto rewards and/or to pay for goods or services with crypto. There are different varieties, with traditional card issuers merely offering crypto-based rewards for purchases, while exchanges allow their customers to spend their crypto with merchants who don’t (yet) accept such payments directly. While the latter offer a limited off ramp – permitting users to spend crypto but not otherwise transfer or cover their holdings – they have gained some traction as a viable bridge between the fiat and crypto worlds.

Major exchanges such as Crypto.com, Binance, Coinbase, and Gemini offer cards with various fees and features, and payments-oriented platforms such as Bybit, BitPay, and Wirex use pre-funded crypto accounts to permit users to spend with merchants or withdraw through ATMs. Two emerging players in the space closed early financing rounds this week, both securing $10m in new capital.

Interlace, a Singapore-based card issuer and digital asset manager, raised $10m in its Series B1 led by Bitrock Capital. They offer enterprise-level card issuance – claiming over 4.5M cards issued to date with 100+ partners – and carry licenses is the US, Hong Kong, and Lithuania. Proceeds will be focused mainly on building their team, with four key hires announced concurrent with the round closing.

Brighty, a Swiss-based team building crypto-credit card payment technology, also secured $10M in financing this week from Futurecraft Ventures. Brighty provides a digital finance platform to enable card payments, and is hoping to increase adoption through improved user experience and transparency, rewards on stablecoin balances, and integrated AI-enabled investment management functionality.

Both represent smaller rounds for teams building tools to interface between the crypto and traditional financial worlds. Eventually – sooner or perhaps later – we expect the crypto and fiat words to be integrated and hopefully seamless. But that will take some time, and in the interim, these rounds demonstrate investor conviction that linking crypto to real world payments and usage remains ripe for innovation and improvement.

————————————

Contact ryan@architectpartners.com to schedule a meeting.