January 27 – February 2 (Published February 5th)

PERSPECTIVES by Todd White

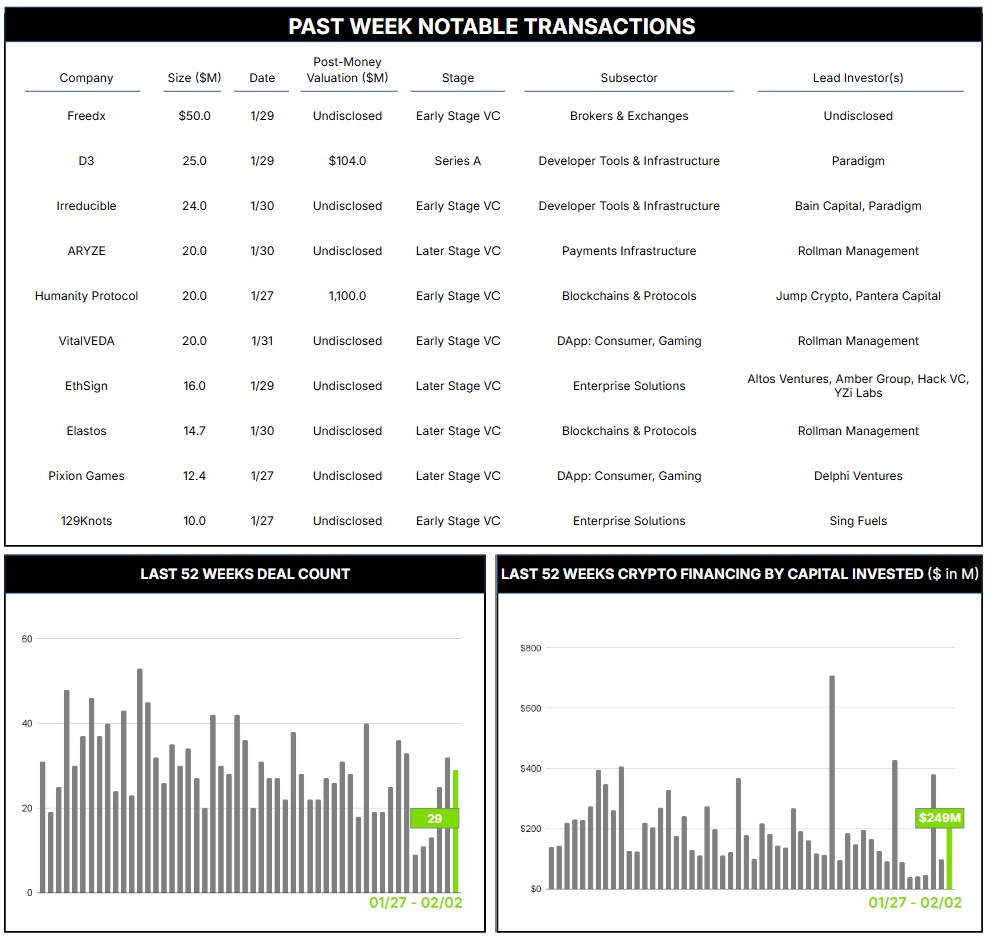

29 Crypto Private Financings Raised: $249.3M

Rolling 3-Month-Average: $162.7M

Rolling 52-Week Average: $202.7M

The concepts of security, identity management, and privacy are in many ways interlinked, and the potential for vast improvements in each has been woven throughout the story of blockchain and Web 3.0 technologies. While so-called Web 2.0—characterized by user-generated content, interactivity, and collaborative online experiences such as social media—dominates current internet usage thanks to established infrastructure and user-friendly interfaces, proponents of Web 3.0—characterized by decentralization, user-centric online experiences built on blockchain, AI, and machine learning, “trustless” interactions, and ubiquitous connectivity—believe that the underlying philosophies of decentralization, security, and, most of all, privacy will drive an inevitable transition and integration with all things Web 2.0.

Yet this transition has been hampered by the complexity of the underlying technologies and the notorious difficulty of using them. Two of the largest financiers this week, in their own way, are seeking to address this complexity to facilitate and expand adoption.

D3, the developer of a fully Domain Name System (DNS)-compliant blockchain purpose-built to transform and tokenize Web 2.0 domains as “digital real estate,” secured $25M in Series A funding at a $104M valuation from Paradigm and a collection of their industry notables. Their unique thesis would bring the usual benefits of tokenization—fractional ownership, financial innovation and liquidity, and enhanced ownership options—to perhaps the original digital “real estate”: internet domains. Their goal is to bridge the Web 2.0 DNS and Web 3.0 name systems to more easily connect Web 2.0’s user volume and ease of use with Web 3.0’s structural benefits.

And finally, Irreducible, a startup building zero-knowledge proof (ZKP) infrastructure for transaction and identity verification, locked a $24M early-stage round, also led by Paradigm with support from Fenbushi Capital, L2 Iterative Ventures, and Robot Ventures. Focused on the efficiency of ZKPs—a cryptographic method that allows one party to prove a statement’s validity without revealing any underlying data—the company was inspired by the high-frequency trading world’s success in combining specialized hardware with software-enabled trading algorithms. By matching the hardware in their own data center, using field-programmable gate array (FPGA) chips that can be customized for specialized computations, with co-designed software and ZKP protocols, they seek faster execution with lower power consumption to ultimately achieve the precise privacy benefits that ZKP technologies provide.

Contact ryan@architectpartners.com to schedule a meeting.