March 10th – March 16th

PERSPECTIVES by Eric F. Risley

In this case, the near-medium term future is crystal clear.

Stablecoin-based payments have the momentum and will become a meaningful proportion of global payments, both business and consumer, over the next five years. Not all forms of payment are well suited, but today the value proposition of cross border payments is clear and compelling. The more opaque piece of the puzzle is whether the ease and value proposition of using stablecoins for cross border payments transitions into holding the same for local and everyday payments for goods and services, particularly in countries with inflation or a history or devaluations.

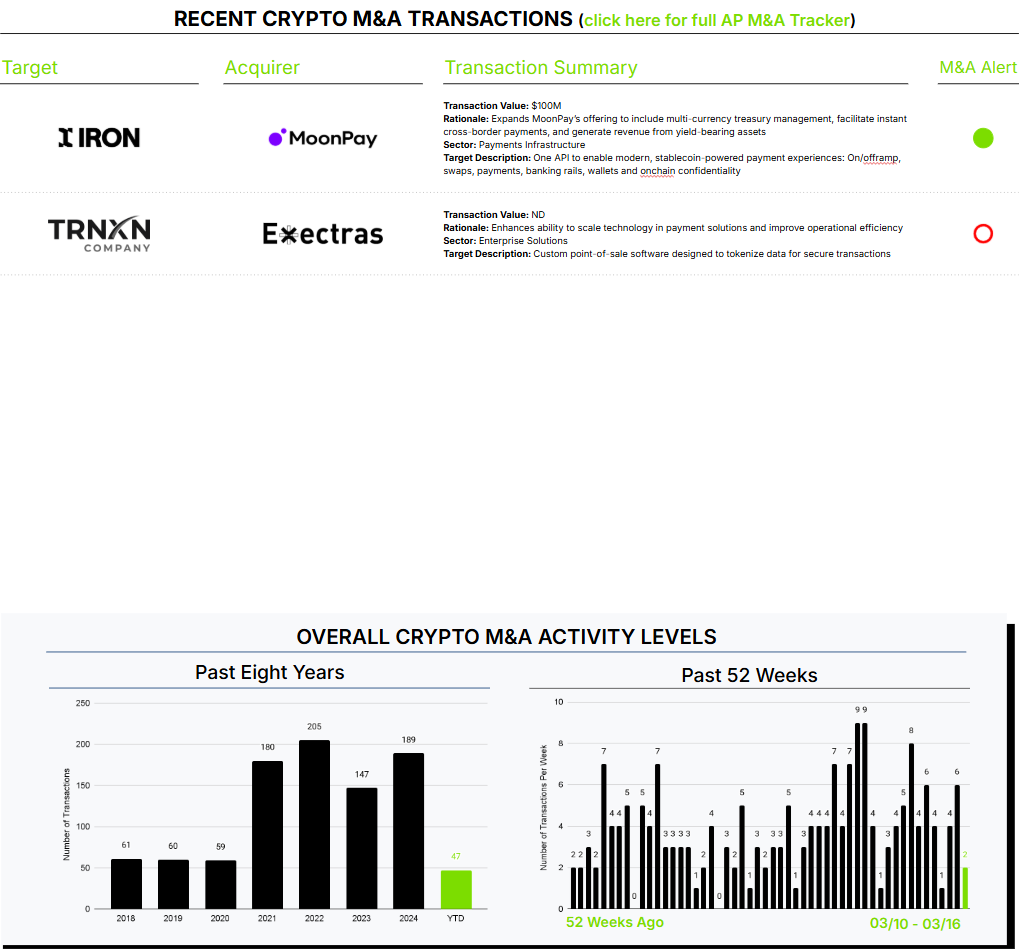

This week Moonpay announced the acquisition of early stage stablecoin payment infrastructure provider, Iron. Iron offers a turn-key stablecoin payment APIs, enabling developers to integrate global on/off-ramps, swaps, banking rails, payments, wallets, and virtual accounts into their applications. They serve PSPs, Fintechs, Banks, Enterprise Wallets, Remittance Platforms, FX Platforms, Treasuries, Onchain Banks, etc. This follows Stripe’s acquisition of Bridge several months ago, offering somewhat similar capabilities (AP M&A Alert).

As said well by Ivan Soto-Write, today’s cross border payments are like international phone calls before the advent of Skype and Apple Facetime, widely expensive. In the case of payments add slow (often days), and are difficult to track status. Ripple was the first to build its business around this use case and value proposition, starting by using their XRP token, rather than a stablecoin. Since then, stablecoins have emerged as the preferred instrument for these payments and many, including Ripple are embracing this reality, building both business and consumer-focused businesses to capture this opportunity.

It’s plain as day that others will follow, including those who already own the customer relationship; banks, enterprise payment software providers and a wide variety of financial technology companies.

Read more in our M&A Alert highlighting the Iron | Moonpay acquisition here.