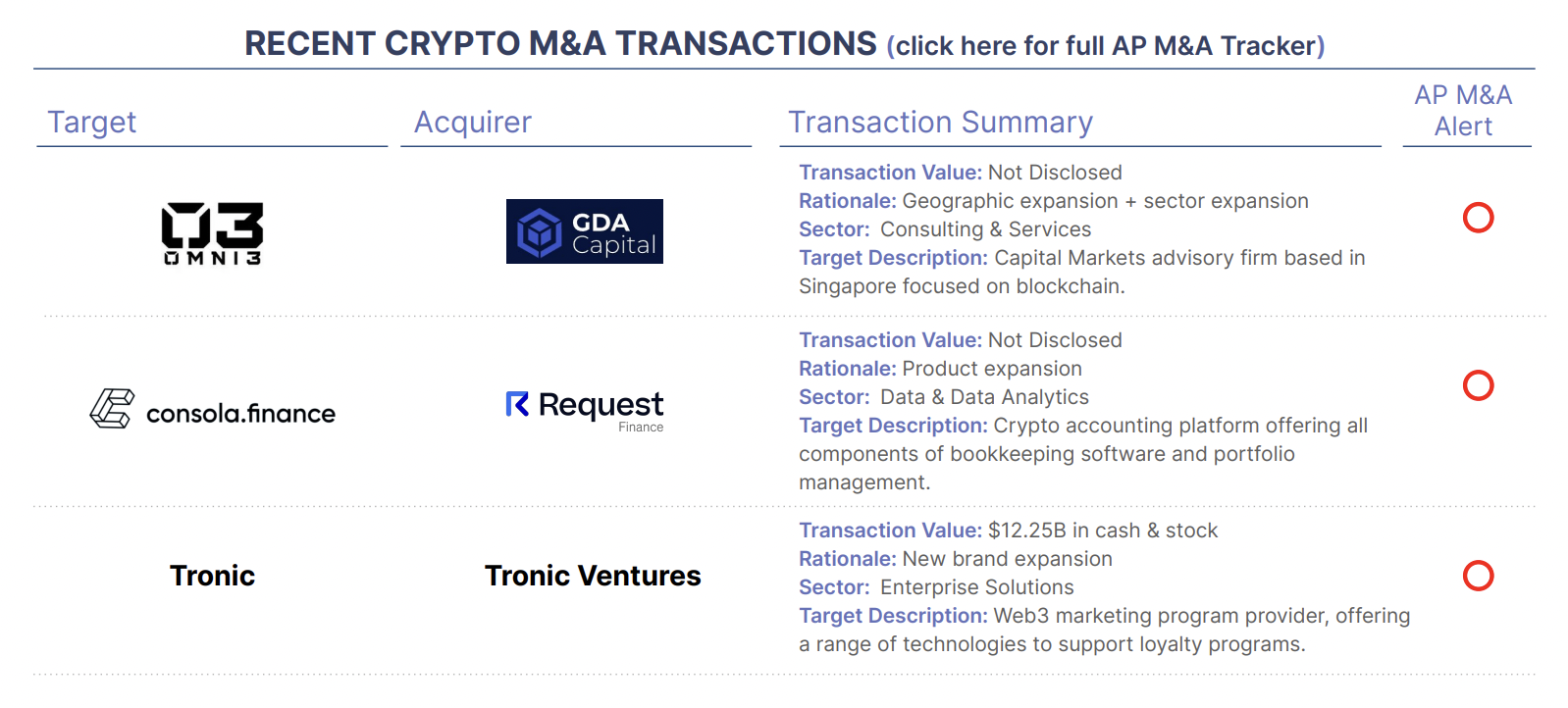

Three announced crypto M&A transactions this week, including one mega deal.

Fintech startup Request Finance of Paris announced the acquisition of Vienna-based cryptocurrency accounting platform Consola Finance. Request is a Web2/Web3 payments platform, offering crypto or fiat payment tools for accounts payable/receivable and payroll. They claim $700M+ in payments to date, and have raised $5.5M from investors such as Animoca, Balderton and Sebastien Borget. Consola has developed cryptocurrency-specific accounting functions, allowing users to upload transactions to accounting systems, and has raised €1.1M.

Toronto and New York-based merchant bank/digital assets advisory firm GDA Capital announced the acquisition of Omni3, a digital asset advisory firm based in Singapore. GDA will use this group as its lead in Asia blockchain and gaming advisory.

In by far the largest announced crypto deal of the year, Dallas holding company JBB Advanced Technologies announced it will sell 100 percent of its digital marketing subsidiary Tronic to a new entity called Tronic Ventures, through cash and shares worth $12.250 billion. Tronic is web3 marketing program provider, offering a range of technologies to support loyalty programs. Tronic was launched in 2021 and acquired by JBB in January 2023, but we can find no announcement of prior funding or revenues, and Tronic appears to have only 20-30 employees. Christina Marshall had been the President of JBB and is now head of Tronic Ventures, but we can find no website or funding source for this new spinout and will continue to research further.

Events

Architect Partners will be at Digital Asset Summit London (3/18 – 3/20) and the Game Developers Conference in San Francisco (3/18-3/22). Please contact elliot@architectpartners.com or arjun@architectpartners.com to meet.