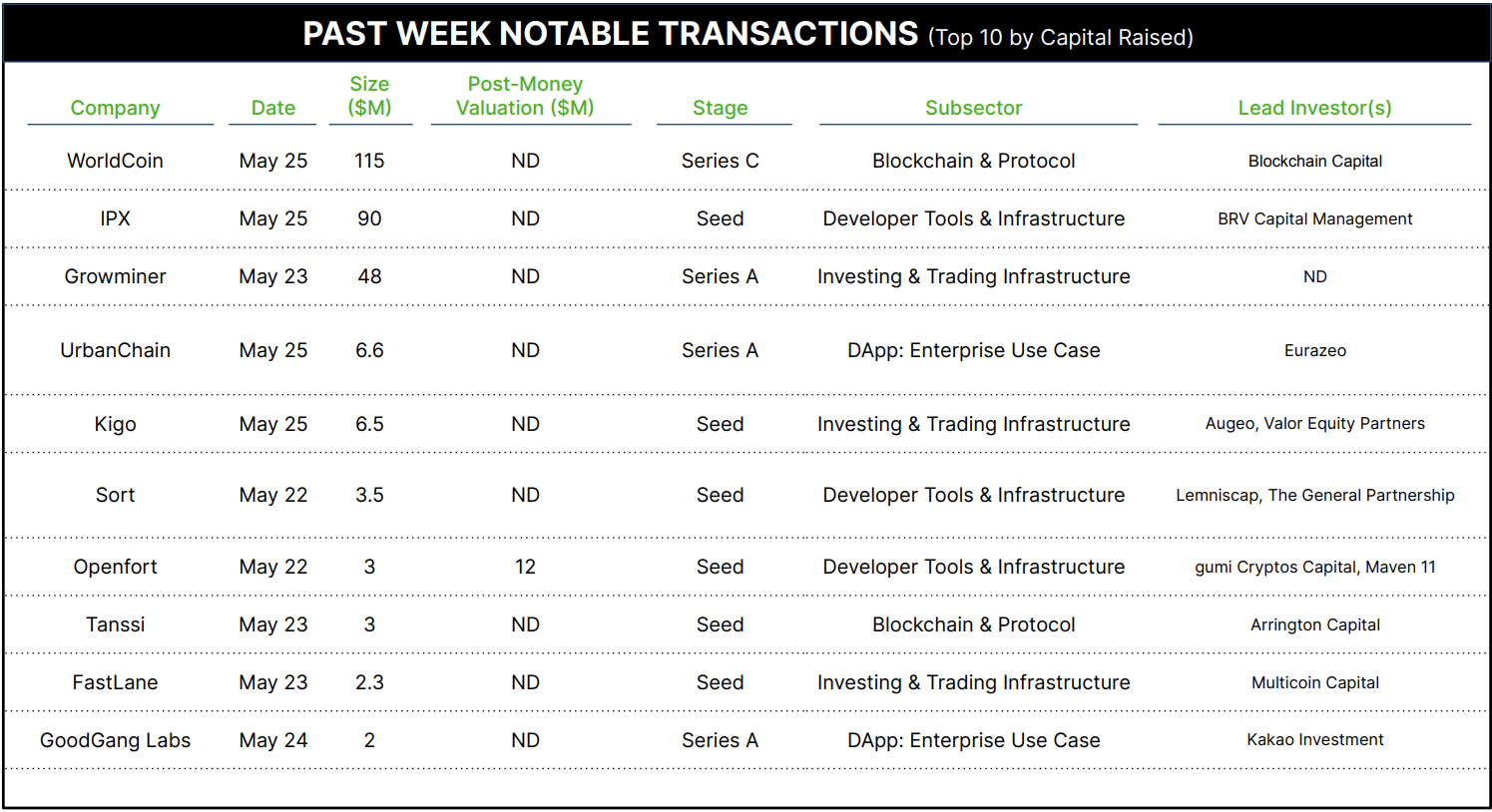

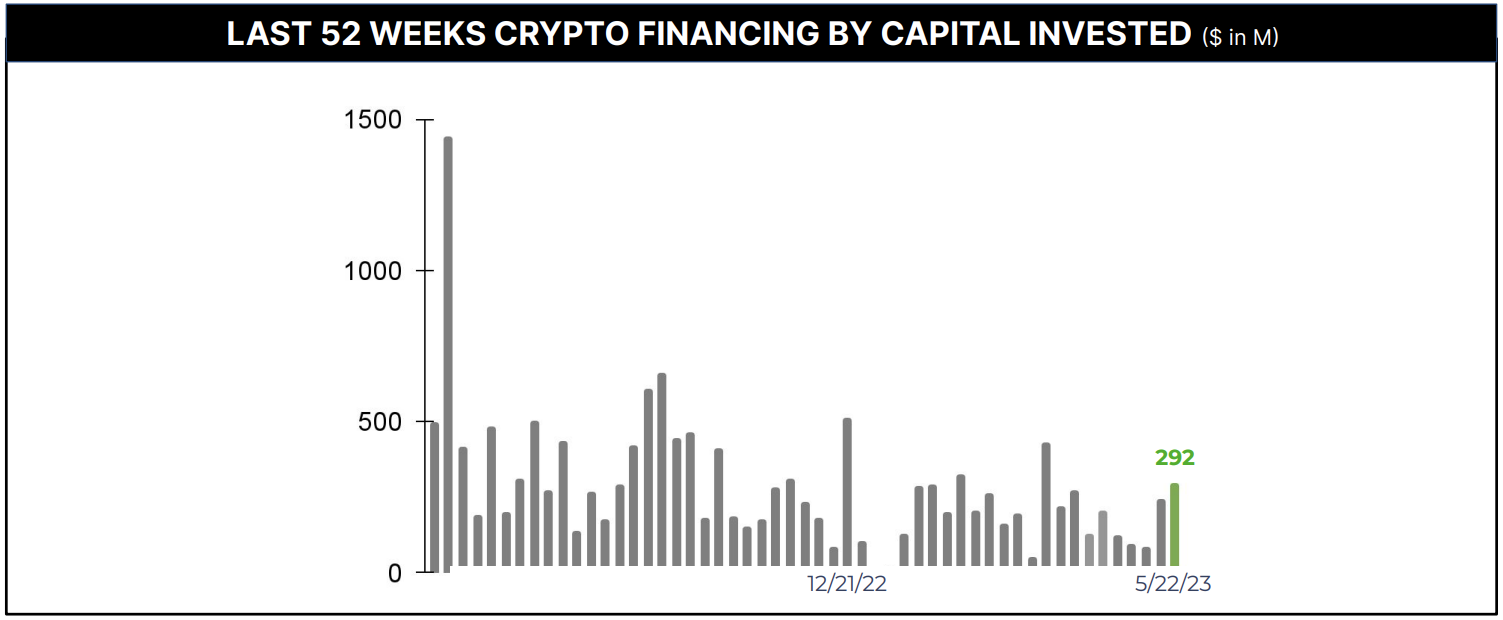

27 Crypto Private Financings Raised ~$292M

Last week was again fairly active in crypto private financings, with 27 announced deals totalling $292M in disclosed capital raised. As has been the trend for most of this year, our top ten list is again dominated by seed and Series A financings.

Long-time crypto investors Arrington, gumi crypto and Multicoin were all active last week, continuing to build via $2-3M seed rounds. We’re interested to see more from gumi’s Openfort investment – Openfort talks about allowing developers to “blend blockchain invisibly into the backbone of your games”, a requisite to overcoming friction.

The one exception to the early-stage trend is Worldcoin, with the largest raise at a $115M Series C. Blockchain Capital led this round, with participation from a16z crypto, Bain Capital Crypto, and Distributed Global. Worldcoin, led by Sam Altman, has now raised a total of $240M, including a $100M ICO in March 2022 led by a16z and Khosla Ventures.

Worldcoin, currently in beta, is aiming to evolve into the largest, most inclusive global identity and financial network. Its wallet, World App, has about 2 million users across five continents, en route to a target billion users. Central to Worldcoin’s privacy-centric positioning is The Orb, a biometric device that scans the retinas of users, so they can later confirm their identity online.

There is certainly some controversy around Worldcoin. Blockchain Capital partner and lead investor Spencer Bogart tweeted “Worldcoin is quite likely the single most misunderstood project in all of crypto (and that’s saying something). At first glance, it appears to be a noxious combination of hardware, biometrics, crypto and AI. For good reason, folks get concerned and sensitive when it comes to biometrics— particularly so when you add a dose of crypto”.