Our team will be at Money2020 in a week. Please email ryan@architectpartners.com if you’d like to meet.

Data and data analytics is a crucial segment within crypto. Data reveals the most fundamental questions like, “what is the price of Bitcoin?” and simply put, informs every crypto asset investment made. Data’s value extends far beyond price data and includes being the key ingredient for trading markets, reveals the use and trends of blockchains, powers trading risk management and lending risk management, identifies and stops fraud, drives regulatory compliance, identity, accounting, auditing and taxes, informs trading strategies and research, allows an understanding of crypto users, helps improve application use and performance, informs marketing efforts, and the list goes on. These use cases touch every single crypto asset market participant.

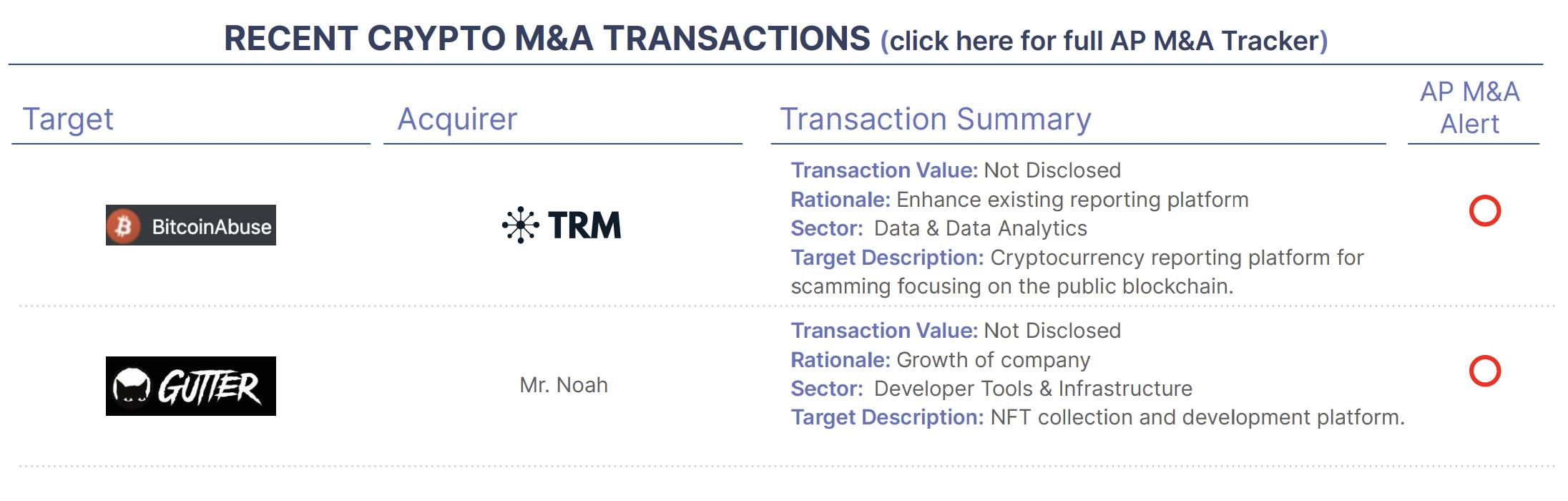

Under this theme, one of the leading data & data analytics companies, TRM Labs, announced the acquisition of Bitcoinabuse.com. Their product, Chainabuse, is a crowdsourced crypto fraud reporting platform designed to reveal and stop malicious activities impacting crypto participants. As is often the case, business development relationships often predate an acquisition. In this case, TRM Labs was an early partner with Bitcoinabuse.com helping to launch Chainabuse.

TRM Labs raised an impressive $70M growth capital round in late 2022 with top-tier new investors Thoma Bravo, Goldman Sachs, Brevan Howard, Geodesic Capital and CMT Digital. TRM Labs is focused on identifying fraud, money laundering and financial crimes and peers include Chainalysis and Elliptic among others. Architect Partners has published a variety of research and insights on the data & data analytics sector, with more coming shortly.