How will the outcome of the U.S. elections affect the crypto industry?

We are writing from Dubai where this question was a key topic in all of our meetings. The message was clear that while certain global jurisdictions have implemented a regulatory framework for crypto and digital asset companies – i.e. VARA in Dubai, ADGM in Abu Dhabi, and MAS in Singapore – the world is still waiting for regulatory clarity from the U.S. before the industry will fully execute its broader strategies.

A comment I recently made to The Information was that in July 2024, uncertainty with the U.S. political and regulatory framework is the only material remaining hurdle for traditional companies to execute their strategic crypto-related initiatives.

Indeed last week was a historic one for our country. As we think about the impact to the crypto industry, there appears to be continued positive momentum with Trump selecting JD Vance as his VP. Vance has shown positivity towards crypto, previously stating that he owns Bitcoin and through his recent voting track record in striking down SAB 121.

Trump continues to vocally support crypto and is scheduled to speak at next week’s BTC Nashville event, which Architect Partners will be attending. RFK is also scheduled to speak at Bitcoin’s largest U.S. conference and it’s notable that two presidential candidates are investing their campaign time into our industry, which is not surprising since it is estimated that there are over 50M U.S. holders of crypto assets and many will be voting as single issue voters.

Also notable is Larry Fink’s Bitcoin journey where he said on CNBC that he “was a proud skeptic … studied it and learned about it … [his] opinion five years ago was wrong … Bitcoin is a legitimate financial instrument”. As Founder & CEO of the world’s largest Asset Manager, some respond that Fink has to say this because Blackrock has created the most successful ETF launch of all time (IBIT). The takeaway is how Fink got to this point. It is my experience that nearly everyone who invests the time to understand the technology and Bitcoin as its first application ends up where Larry is. This includes Jamie Dimon, Michael Dell, and Mark Cuban as recent converts.

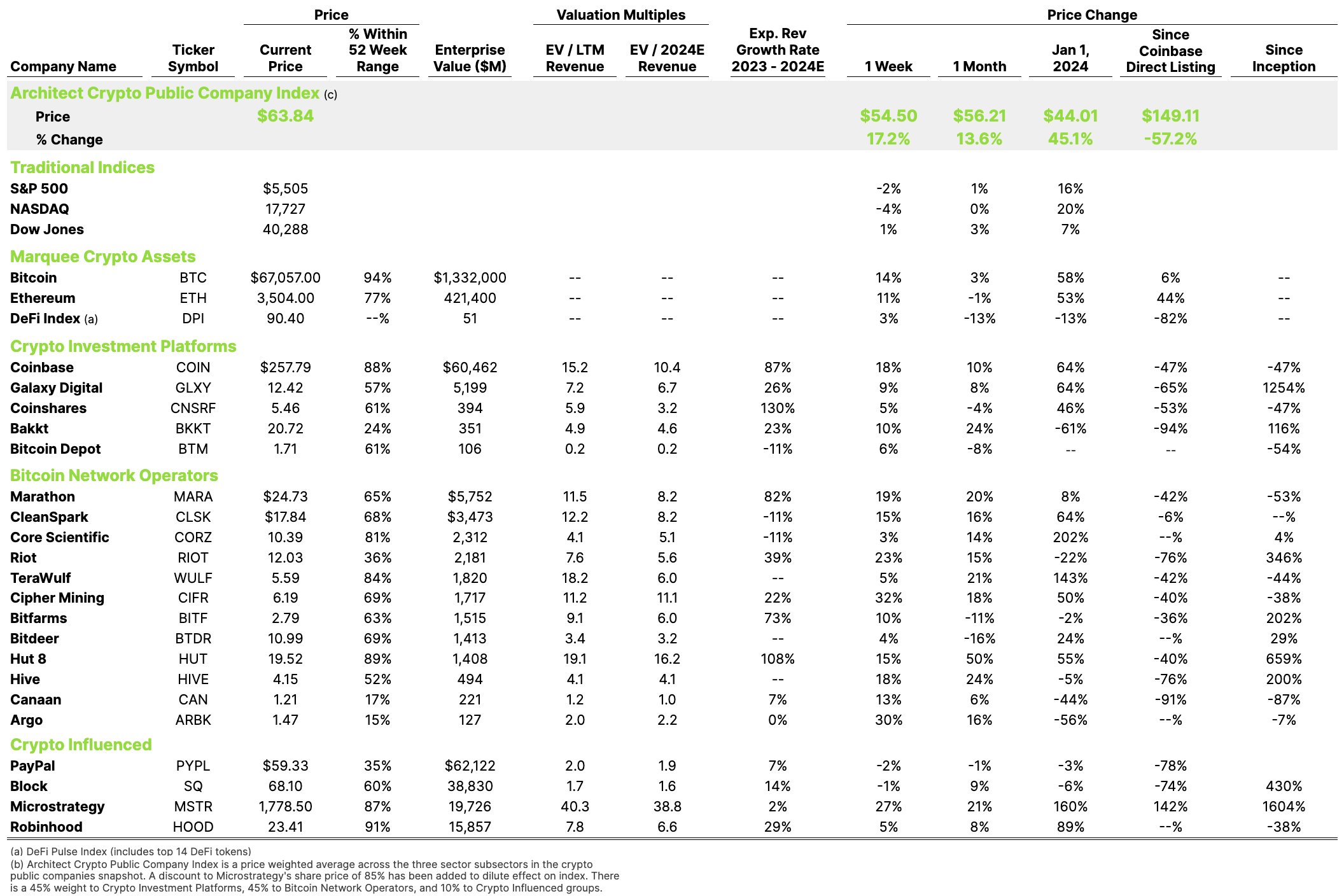

Additionally, despite the current hostile regulatory environment, we have weekly announcements like ETH Spot ETF to trade in 2024, State Street (STT) to explore their own stablecoin and tokenized deposits, Intesa Sanpaolo (ISP.MI) completed a digitally-native bond issuance, and Galaxy Digital (GLXY) acquired the staking assets of CryptoManufaktur, which falls squarely into the build comprehensive services M&A strategy we have been talking about.

Because of the growing number of U.S. crypto participants, the endpoint of the blockchain discovery journey and the continued adoption from publicly traded companies, I believe any outcome to the U.S. elections will be a net positive for our industry.

And just imagine if the U.S. election resulted in someone who openly supports blockchain and crypto. Indeed, the Great Surge is here.