November 4th – November 10th

PERSPECTIVES by Eric F. Risley

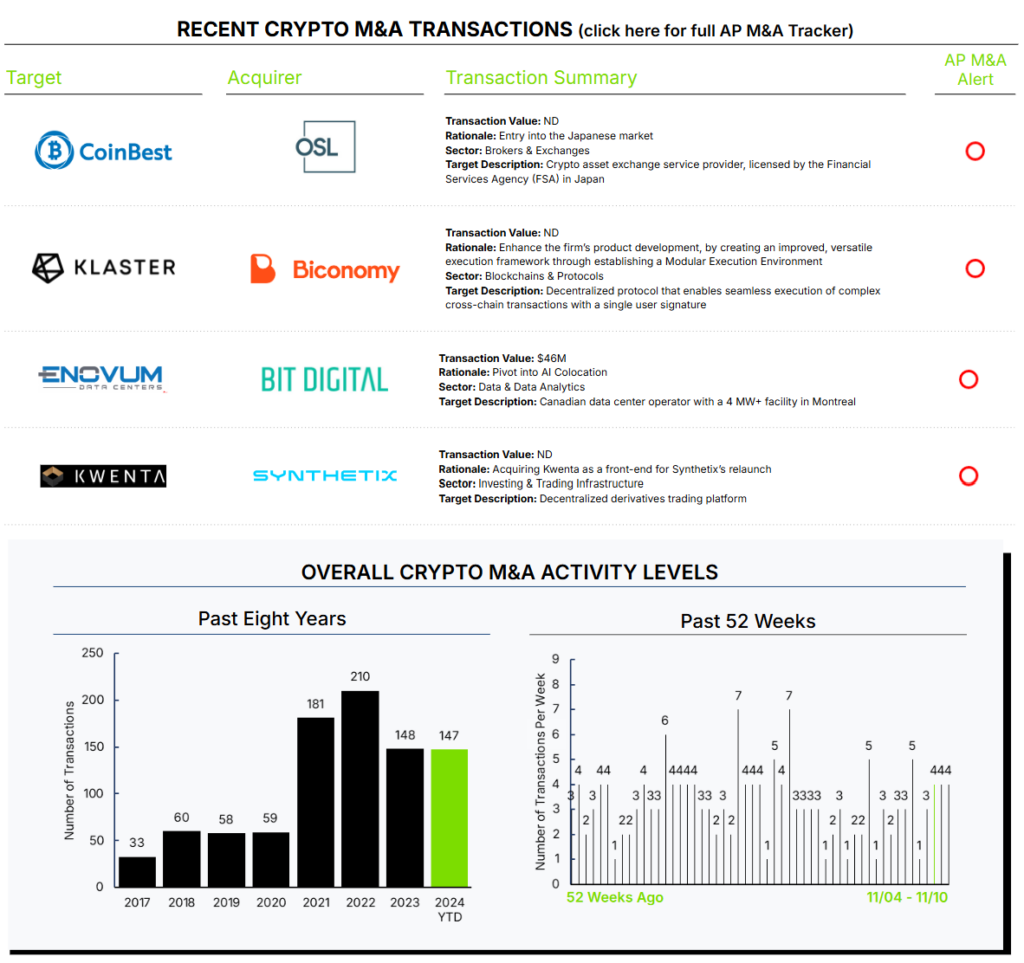

Historically, crypto brokers and exchanges have been active acquirers, often at premium values. This changed during Crypto Winter, when they universally became cautious, for many good reasons.

So far, in spite of generally good business performance since Crypto Winter broke in October 2023, brokers and exchanges have not yet fully returned to acquisitions as a tool for strategy. There are several reasons, including regulatory dysfunction in the U.S., newly formed management prudence following a long and difficult Crypto Winter, and the characteristics of the post-Winter trading markets, particularly trading volume.

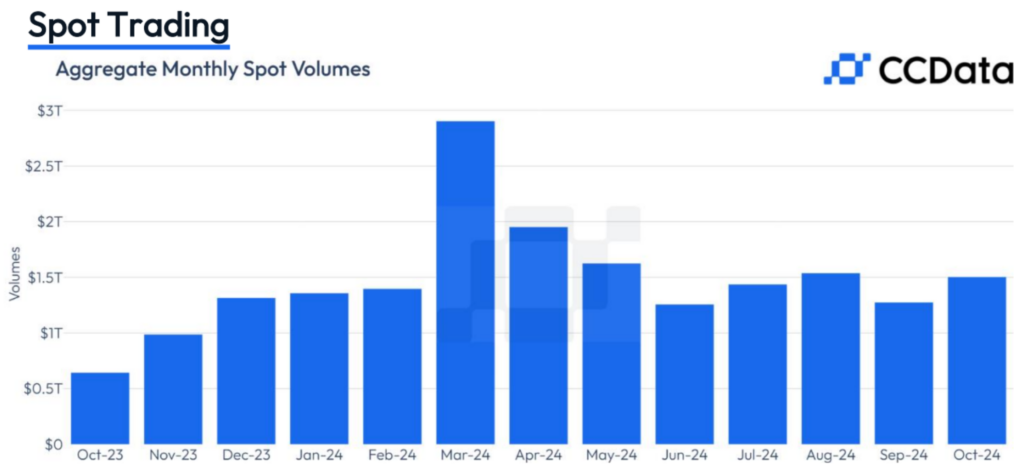

Trading volume is the economic engine for brokers and exchanges, driving the majority of revenue for most. As such, we often assess trading volumes, rather than asset prices, as the key determinant of “health” for this portion of our industry.

As demonstrated by the CCData chart below, Crypto Winter broke in October 2023, and trading volume surged for six months. However, since April 2024, trading volumes have been well below the March 2024 peak and roughly flat for the past six months. When assessed on a quarterly basis, CCData reported Q1 2024 volume totaling ~$5.6T; Q2 2024 was down ~15% from Q1, and Q3 was down ~13% from Q2. Interestingly, Coinbase, one of the marquee acquirers, has experienced a somewhat steeper drop-off, with trading volume down 28% in Q2 vs. Q1 and down 17% Q3 vs. Q2, according to their regulatory filings. Generally speaking, the conviction to execute acquisitions requires strong confidence in the financial health of the acquirer’s business. This has simply been lacking over the past six months.

The past several weeks show early promise that this dynamic may be changing. According to Messari, overall centralized exchange volume was up 258.9% compared to the previous week; however, one week does not a trend make.