November 4 – November 11 (Published November 13th)

PERSPECTIVES by Todd White

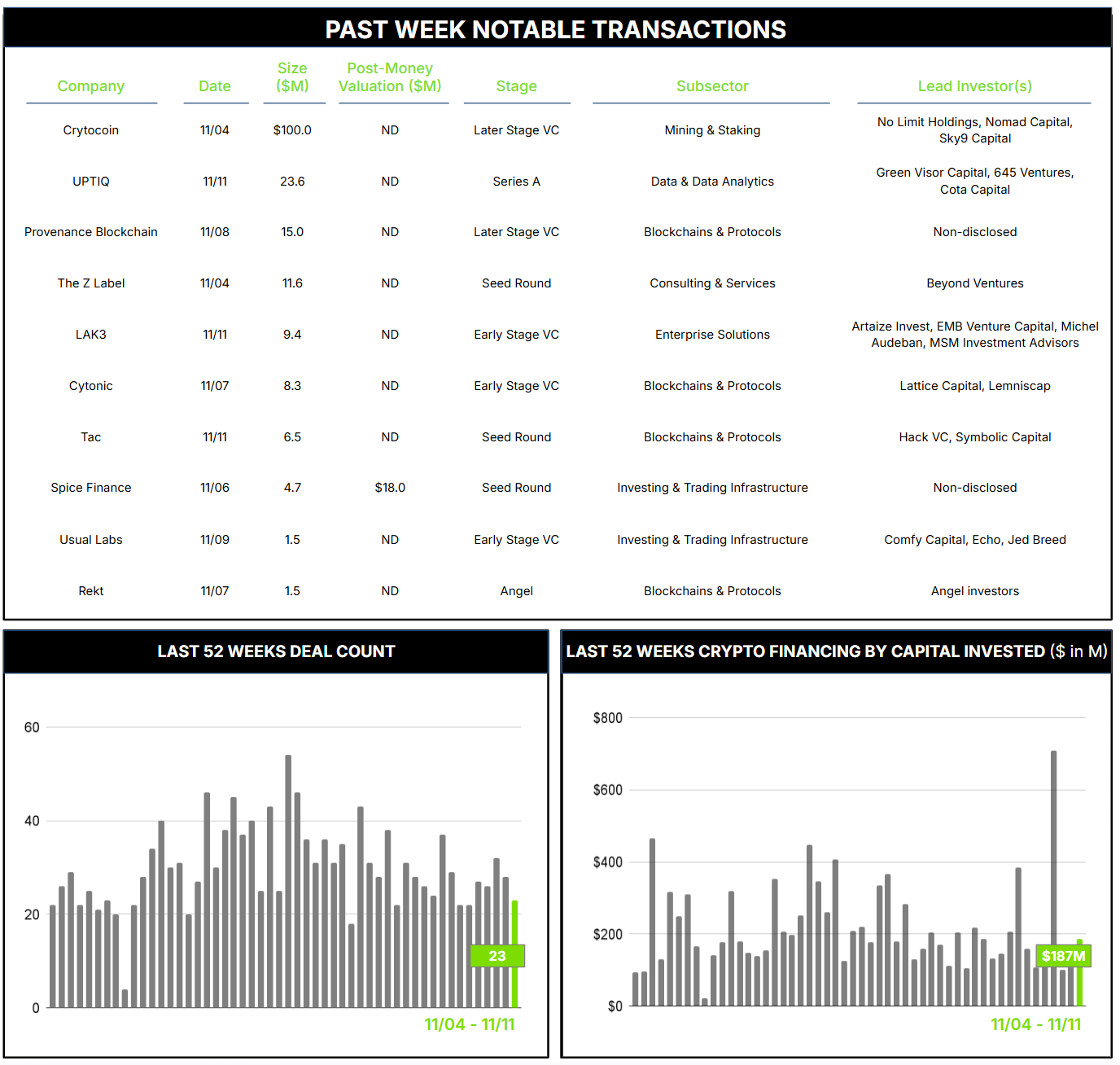

23 Crypto Private Financings Raised: ~$187M

Rolling 3-Month-Average: ~$216M

Rolling 52-Week Average: ~$218M

I first learned about Bitcoin at a Freedom and Unity Festival in 2012. I saw an intellectually fascinating form of digital money created and managed by a community of libertarians and programming geeks but completely failed to comprehend the investment opportunity or discern the digital asset phenomenon that was unfolding before my eyes. I clearly didn’t get it.

A few years later, a friend and professional mentor quit his job as the global head of something important at a Big 4 accounting firm to dedicate his energy toward Bitcoin mining. He had discovered BTC as a means of efficiently transferring wealth back to the U.S. during a multi-year assignment in Asia. But his timing coincided with one of BTC’s early runs, so “Bitcoin Jim” soon started doing better financially by applying his programming acumen on an overbuilt gaming machine in the evenings than from his considerably lucrative day job. He eventually cut the cord to the TradFi world and filled his basement with pricey, power-hungry computers. I thought he was slightly nuts—but I still clearly didn’t get it.

Soon thereafter, mining became the exclusive province of well-funded (and/or highly leveraged) enterprises running sophisticated facilities with increasingly specialized equipment and an insatiable appetite for computing and electrical power. Many of these became the network operators that pervade our public crypto index. The path of “Bitcoin Jim” seemed forever beyond the reach of mere individual aspiring libertarians and geeks alike.

A similar tale can be told for staking and validator nodes for other cryptocurrencies. The cost and scale needed to run effective operations in very competitive markets can be prohibitive, and some argue that the consolidation of validation and staking nodes among sizable players can even undermine the decentralized nature of crypto in general.

CrytocoinMiner is seeking to reverse this trend with cloud-based mining infrastructure and decentralized governance designed for individual enthusiasts to “passively earn Bitcoins without any restrictions, regardless of technical knowledge or financial resources.” Investors have supported their vision with a $100 million strategic financing round that closed this week, with support from Nomad Capital, No Limit Holdings, Sky9 Capital, UOB-Signum Blockchain Fund, Interop Ventures, and nine other well-known institutional investors. The proceeds will be deployed to accelerate decentralized governance and expand their technology stack. Yet another infrastructure play with meaningful capital support from investors who believe in CrytocoinMiner’s vision. Hopefully, they prove to “get it” this time around better than I did in those distant early days of crypto.

————————————

Contact ryan@architectpartners.com to schedule a meeting.