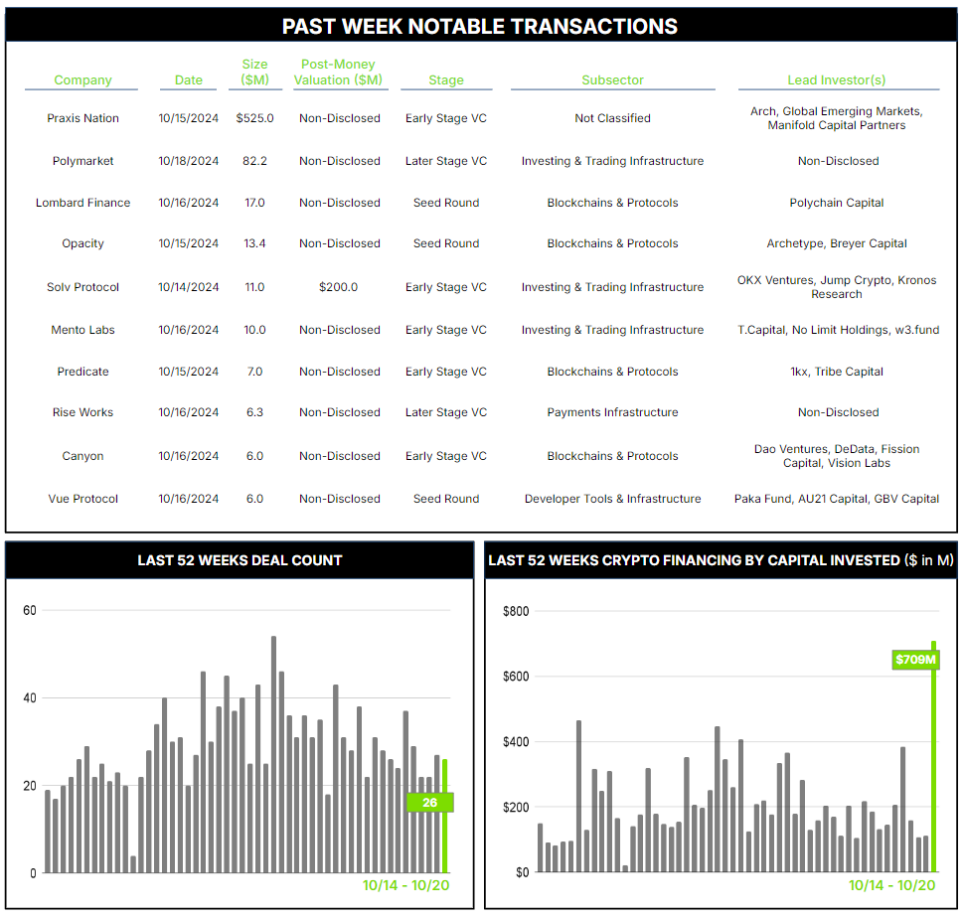

26 Crypto Private Financings Raised: ~$709M

Rolling 3-Month-Average: $223M

Rolling 52-Week Average: $216M

The CFTC is unhappy with the so-called prediction markets, but investors and users have a markedly different view.

Event-based derivatives platforms, known as “prediction markets,” allow users to stake stablecoins against the results of certain events using “winner-take-all” binary options contracts. The CFTC argued successfully in 2021 that such contracts are regulated derivatives under their purview, securing a $1.4 million fine and forcing the NY-founded leader Polymarket offshore and away from U.S. markets for failing to register its exchange with the CFTC.

More recently, the CFTC attempted to ban U.S. election-based contracts as a form of gambling (though a meaningful distinction between gambling and derivatives speculation may be hard to discern). But Kalshi, a registered US platform, prevailed with the D.C. Circuit Appeals Court on October 2, permitting them to legally list U.S. election odds on their exchange. The result has been a flood of activity, although Kalshi still lags behind market leader Polymarket.

It’s hard to say whether the prediction markets offer better or worse insight into event probabilities—Elon Musk has famously claimed they are superior to polls, though The Block’s Byron Gilliam advises caution in equating prediction prices with actual outcome probabilities in yesterday’s blog.

Either way, the prediction markets are booming with users, and investors are following suit. Blockratize, Inc., which does business as Polymarket, leads the market and followed its $70 million Series B offering in May with an additional $82 million reported on a Form D filing last Friday. While the company has been quiet about this round and its use of funds, it reportedly continues to operate at a loss despite its commanding position.

We’ll avoid trying to predict where the prediction markets are headed, but it is encouraging to see a sizable close for an on-chain company demonstrating impressive market fit.

————————————

Meet Architect Partners at these upcoming events:

- Lugano’s Plan B (Oct 25 – Oct 26)

Contact ryan@architectpartners.com to schedule a meeting.