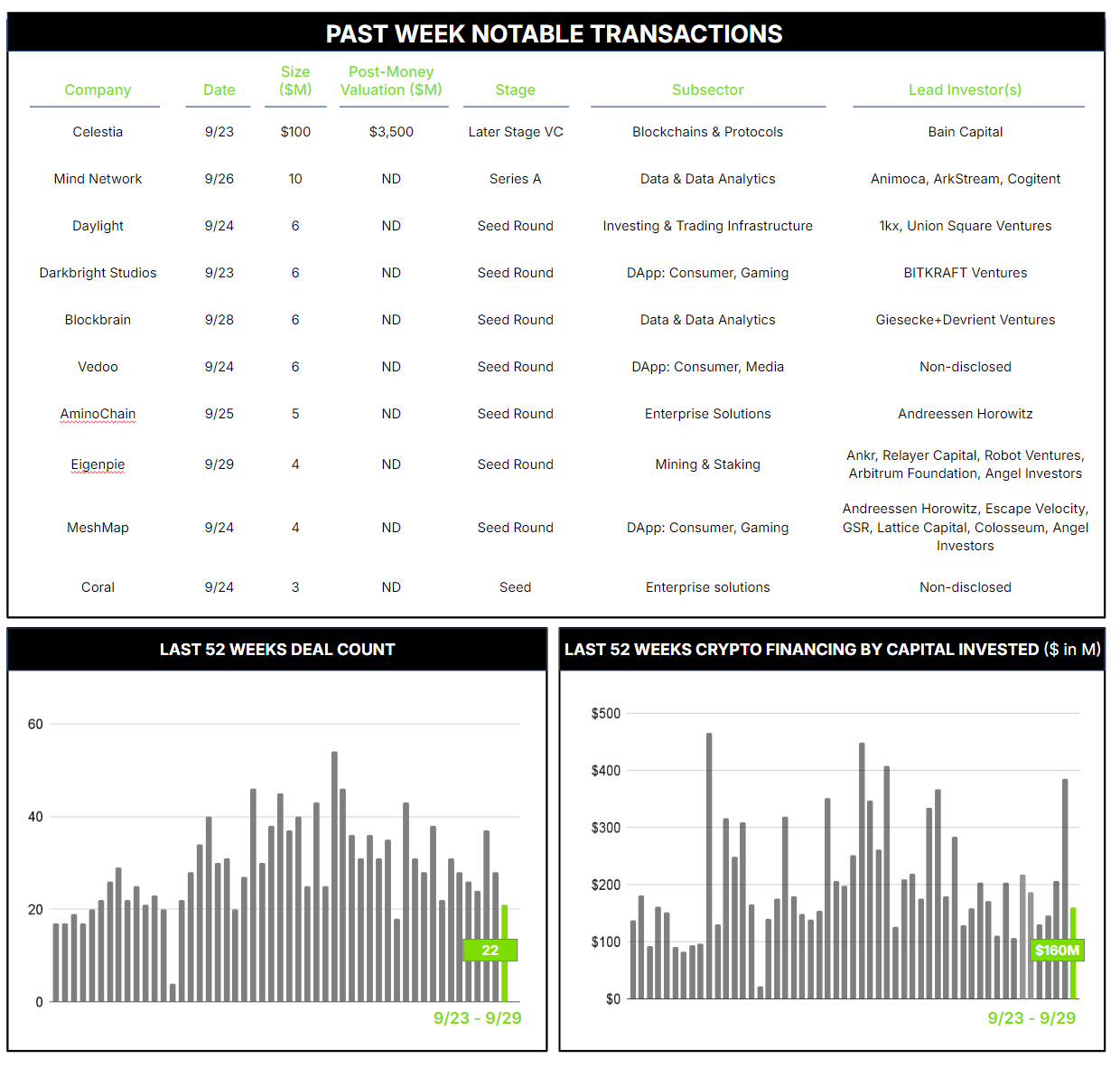

22 Crypto Private Financings Raised: ~$160M

Rolling 3-Month-Average: $186M

Rolling 52-Week Average: $207M

Blockchain processing congestion has long challenged the scalability needed for mass adoption of web3 and blockchain based solutions. For example, Bitcoin was originally posited as an alternative currency to store and transact for value, although the 6 minutes or so required to validate individual blocks proved too slow for convenient use. Solutions such as the Lightning Network attempted to fix this by bundling transactions into aggregated blocks, allowing something closer to instantaneous transactions while still operating on the Bitcoin blockchain. But the throughput problem has remained a barrier for many traditional blockchains, including Ethereum, which must process its consensus mechanism, supporting data, and execution on a single layer. This can lead to major bottlenecks which impair speed and efficiency, increase costs, and hamper usability and adoption.

Enter Celestia Foundation, a modular network that launched on Mainnet last October. Celestia offloads data requirements by separating consensus and data availability from execution. This helps layer-2 developers manage congestion in order increase speed and efficiency, reduce costs, and ultimately improve scalability. Celestia claims to be the first, but they are not alone in developing modular data solutions – others include EigenLayer’s EigenDA and Polygon’s Avail – although they do not claim the same data capacity as Celestia. Celestia aims to achieve 1 GB blocks, which would allow for transactions to be processed several times faster than the Visa network.

Though somewhat technical in a hyper-technical sector, Celestia’s solution could indeed help scale blockspace “from the dial-up era to the broadband era”, in the words of co-founder and chairman Mustafa Al-Bassam. Apparently some sophisticated investors agree, as evinced by last week’s $100m funding round led by Bain Capital Crypto, with support from 1kx, Syncracy and Robot Ventures. We have long applauded developers who continue to build critical infrastructure in the down market; those at Celestia may have developed a key component to drive a market resurgence.

Meet Architect Partners at these upcoming events:

- Permissionless (Oct 9 – Oct 12)

- Money2020 (Oct 27 – Oct 30)

Contact ryan@architectpartners.com to schedule a meeting.