As crypto (crypto assets and digital assets) solidifies itself as a sustainable asset class, market participants must have different tools to track the performance of the industry. Bitcoin has long been the bellwether gauge of the industry’s performance with Ether sprinkled along the way, but neither are comprehensive in capturing the impact that this technology is delivering across all industries.

There are a few indexes that seek to track the performance of our industry, including the CoinDesk20 Index, Nasdaq Crypto Index, S&P Cryptocurrency Broad Digital Market Index, and STOXX Digital Asset Blue Chip Index. Each index covers a specific area of the industry, ranging from tokens to publicly traded companies.

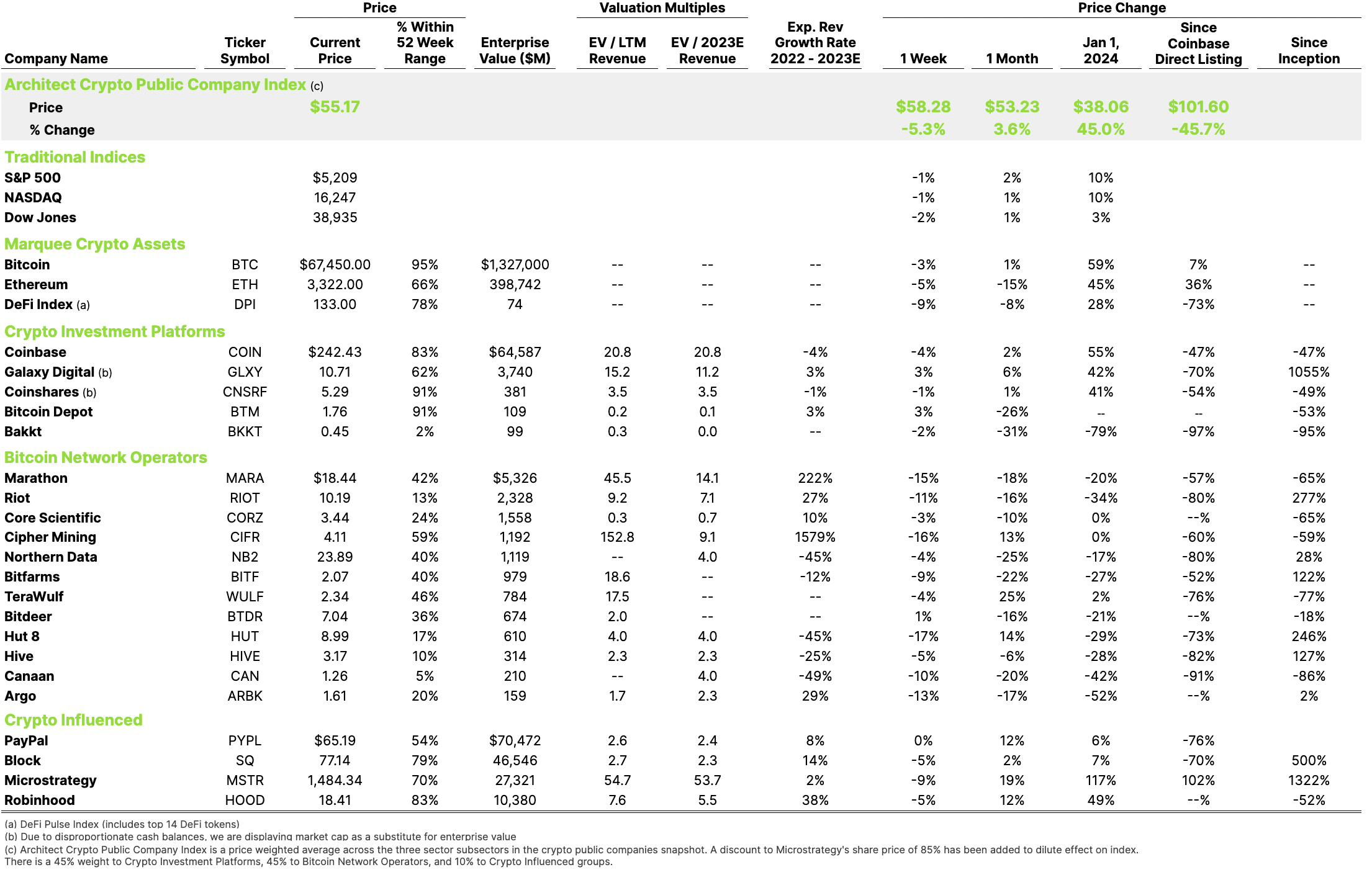

In understanding the importance of having these tools that legitimize the crypto industry, we created the Architect Crypto Public Company Index. Our objective is to track the performance of publicly traded companies that are crypto-native or that have significant parts of their business driven by the use of blockchain.

Established on April 14, 2021 (the day Coinbase went public), the index is a price weighted average across the three Subsectors in our crypto public companies snapshot.

The current Subsector weightings are:

- Crypto Investment Platforms – 45%

- Bitcoin Network Operators – 45%

- Crypto Influenced – 10%

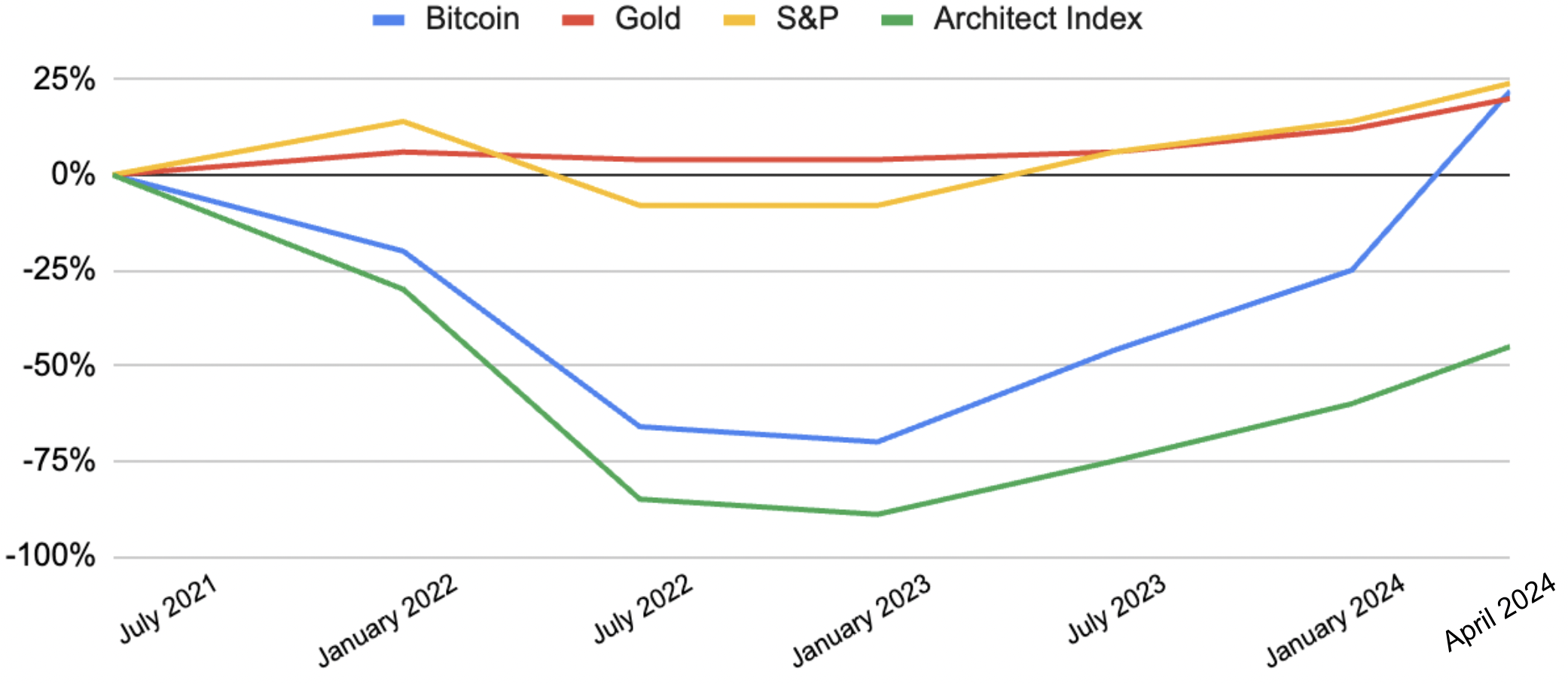

In the bottom graph, we compare the performance of the Architect Crypto Public Company Index against Bitcoin, S&P 500, and Gold. The Index lags versus BTC and has still not recovered to its Apr 2021 launch value, but its last 12 month performance is impressive.

As blockchain and crypto percolates throughout most publicly traded companies and transitions from emerging tech to essential tech, we expect to add more names to this index and see sustained outperformance going forward.

From a conference perspective, we attended NFT.NYC this week and the good energy continues to build. NFT.NYC is known for driving adoption in the individual user demographic. We will be at Paris Blockchain Week Apr 9 – 12.