Are tokens securities?

In some cases, a hearty and welcome yes. This week two traditional financial services businesses executed what we term “bridge transactions”, bridging crypto and traditional financial services. While certainly far too early to call a wave, this type of translation and strategic rationale will eventually become commonplace. We track this trend as it’s a valuable measure of the maturity of crypto and digital assets as a new industry sector. This week neither were particularly material transactions, but represent the theme well.

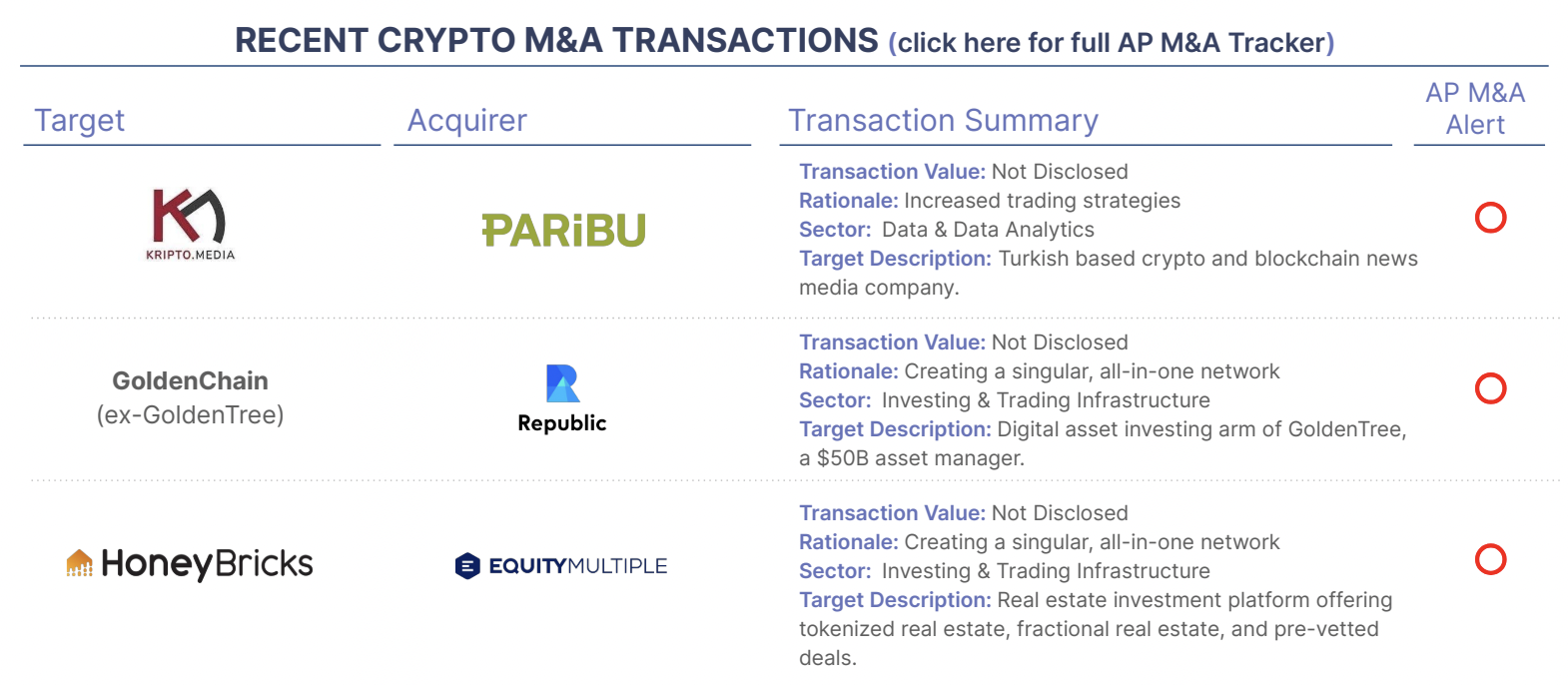

EquityMultiple, a traditional multi-family real estate portfolio manager, acquired a real estate tokenization business, HoneyBricks. HoneyBricks was simply a multi-family real estate investor attracting smaller investors by slicing ownership into smaller units and offering them as a token. In every respect, a security. The idea is “democratization of ownership”, offering access to a traditional institutional asset class, directly to the masses. HoneyBrick claims 3,500 investors supporting $180M in multi-family real estate assets. Tokenizing an asset like real estate, or any other traditional asset, does have some practical advantages, however, proving these advantages, at scale in the real world, remains a myriad of “experiments in process”. This topic is worthy of far more discussion and our team at Architect Partners has many nuanced thoughts and observations.

Republic, an investment platform offering early stage company equity to accredited investors has further augmented its digital asset and now crypto capabilities by acquiring GoldenTree’s crypto asset business unit. While small, between $120M – $150M in crypto assets under management, Republic is also bringing Joe Nagger, the unit’s CEO, on board to lead Republic’s digital assets business efforts. This follows the announced, but not completed, acquisition of INX, who offers equity tokenization and regulatory-compliant token trading services.